40% of the world's top DAOs are NOT legal! Let's fix that

DAO status won't save you from the law and regulation

Trust me, you don't want to have problems with the regulators, expose yourself and token holders to infinite liability, and cause damages with your illegal DAO.

The days of evading legal oversight by claiming you're "DECENTRALIZED" are slowly coming to an end.

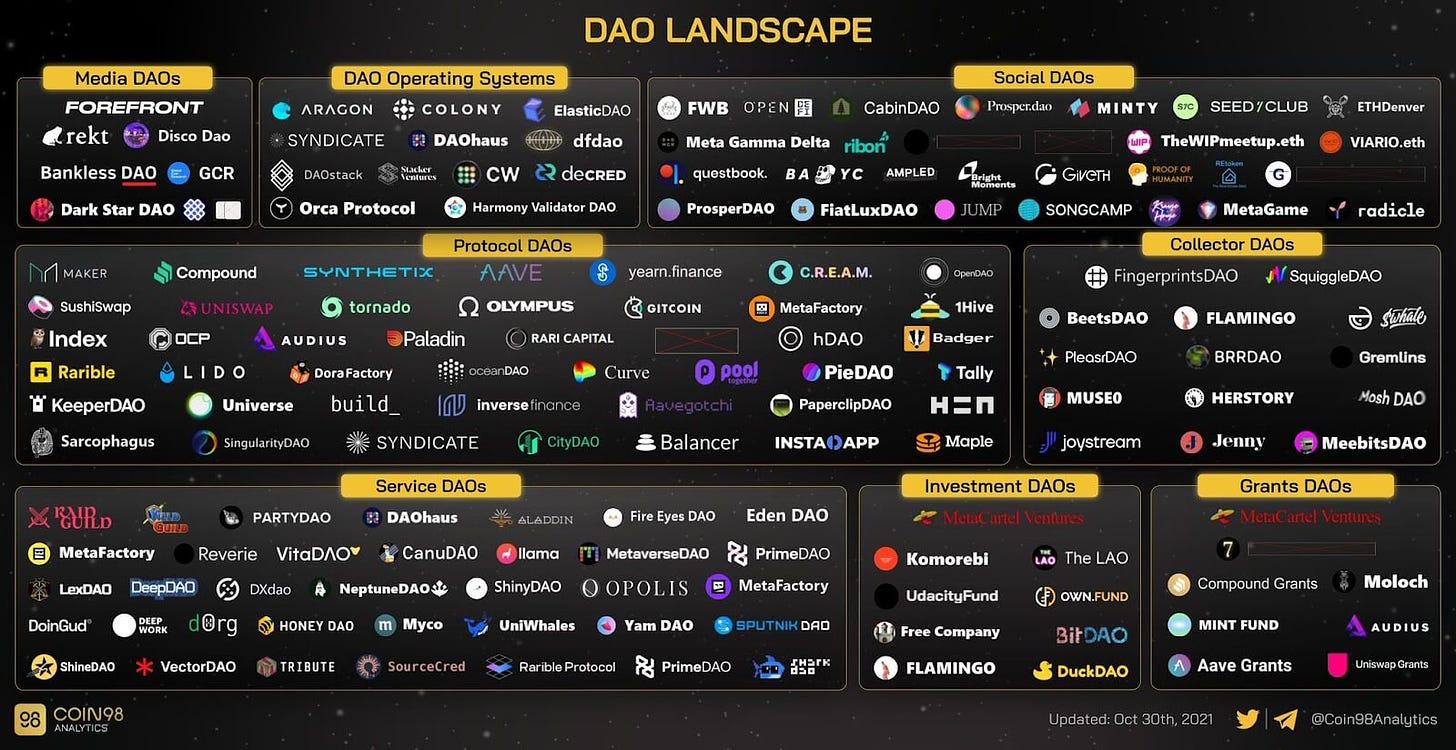

Many projects are set up and run as Decentralized Autonomous Organizations (DAO) that enable governance in line with the value of decentralization.

The core team is behind the crypto project, building key products and critical pieces of the infrastructure, while the token holders - in theory - can govern the direction of the crypto project through token-enabled voting mechanisms.

DAOs start off their journey in the decentralized world but over time discover - the hard way - that it is very useful to have a foot-on-the-ground in the “real world”.

The real world offers crypto projects governed by DAOs both key crypto service providers (banks, custodians, lawyers, etc), and as well special rights if there is a real-world entity in the form of a foundation or association that can provide protection & limitation of liability to both the token holders and the core team managing the project.

If you're an Investment DAO, Protocol DAO, or Community DAO, you should protect yourself.

If you want to discuss how to set up your DAO in a legal way, write me “DAO” in the comments and I’ll set up a call with you.

You can also read more about setting up your DAO in different jurisdictions in the Pontinova Law report.

You can set up your DAO in popular jurisdictions:

- Switzerland

- Liechtenstein

- Lithuania

- Marshall Islands

- Cayman Islands

- British Virgin Islands

- United Arab Emirates

Here is what you need to know 👇.

Switzerland

Legal Wrappers: Foundation and Association

Highlights: Swiss Foundations, ideal for Protocol DAOs, require a minimum capital of CHF 50’000 and are subject to a 4.25% federal tax, with possible tax exemptions for non-profit purposes. Associations, suited for Community DAOs, require no minimum capital, offering a democratic structure that guarantees flexibility but not anonymity, with similar tax implications as foundations.

Liechtenstein

Legal Wrapper: Foundation

Highlights: Tailored for Protocol DAOs, Liechtenstein Foundations must have a minimum capital of CHF/EUR/USD 30’000 and are subject to a 12.5% corporate income tax, with potential tax exemptions for common public interest and non-commercial purposes.

Lithuania

Legal Wrapper: Private Limited Liability Company (UAB)

Highlights: Best for Investment DAOs, Lithuanian UABs require a minimum capital of EUR 2’500 and are subject to corporate tax rates between 0% to 15%. Offers a straightforward setup and a favorable tax regime for companies.

Marshall Islands

Legal Wrapper: DAO (Non-Profit) Limited Liability Company

Highlights: Suitable for Investment DAOs, no minimum capital is required for RMI DAO LLCs. Offers a pioneering legal framework for DAOs with no corporation tax, capital gains tax, or wealth tax for non-profit entities.

Cayman Islands

Legal Wrapper: Foundation

Highlights: Ideal for Protocol DAOs, Cayman Islands Foundations require no minimum capital and are exempt from corporation tax, capital gains tax, and wealth tax. Robust asset protection and governance with a focus on protocol development.

British Virgin Islands

Legal Wrapper: Limited Liability Company (LLC)

Highlights: Suited for Investment DAOs, BVI LLCs have no minimum capital requirement and benefit from a tax-exempt environment. Provides flexibility and protection for DAO members and investors.

United Arab Emirates (ADGM)

Legal Wrapper: DLT Foundation

Highlights: Designed for Protocol DAOs, DLT Foundations in ADGM must have a minimum initial asset value of USD 25’000 and are subject to a 9% corporate income tax, with possible exemptions for free zone entities.

If you want to discuss how to set up your DAO in a legal way, write me “DAO” in the comments and I’ll set up a call with you.

Read more about setting up your DAO in different jurisdictions in the Pontinova Law report.

Support my newsletter by signing up as a paid subscriber! Thank you.

You can read more about setting up your DAO in different jurisdictions in Pontinova Law report: https://www.cognitoforms.com/PontinovaLaw/PontinovaGlobalDAOLegalReport

Very interesting, I am currently researching DAOs. Any sources you mind sharing?