Bitcoin Mystery Explained: Why Price Isn't Skyrocketing Despite Billions of Inflows in ETFs?

Discover strategies behind ETF-driven Bitcoin trades - and why billions in inflows haven’t yet pushed the price to new highs

You asked me to explain why Bitcoin’s Price isn’t Skyrocketing if Billions are entering into Spot ETFs

You see billions flowing into spot Bitcoin ETFs and think “Shouldn’t this push price up?” 🤔

You need to understand how markets work and how sophisticated investors play the game.

1. It's Not Market Manipulation - It’s Advanced Trading Strategies

I built a crypto exchange, crypto market maker, and traded at a Swiss hedge fund, I can tell you this isn’t about market suppression.

You're seeing a classic cash-and-carry trade - where you buy spot Bitcoin through ETFs and short futures market, capturing a risk-free premium.

It’s sophisticated, but here’s takeaway: this trade doesn’t push price up.

Traders are hedging out price movement entirely.

Their goal?

To profit off difference in prices between spot and futures markets without taking on Bitcoin’s volatility.

2. Spot Buying Paired with Futures Shorting = Delta-Neutral Trading

Traders are holding equal long and short positions in Bitcoin.

They’re not betting on Bitcoin goes up or down; they profit from gap between spot and futures price.

Billions can flow into spot ETFs, while the price remains unchanged.

This is a delta-neutral position - essentially a no-risk position on price direction.

Traders are profiting from the premium between futures and spot prices - hence "cash-and-carry trade".

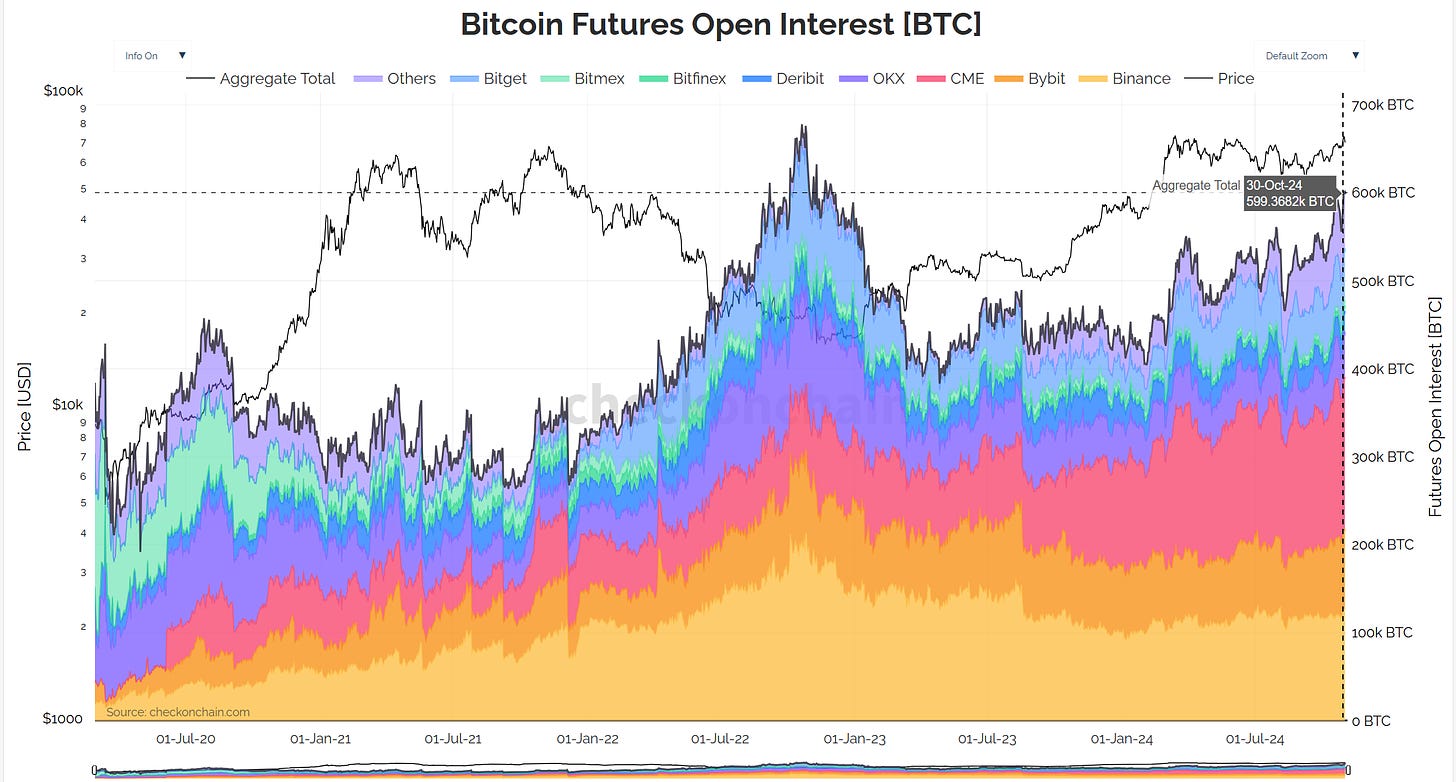

It’s not a small game - open interest in CME Bitcoin futures is at all-time high, confirming big hedge funds are all-in on this strategy.

3. Why Futures Matter So Much in Bitcoin’s Price Dynamics

CME, world’s largest derivatives exchange, has seen massive growth in Bitcoin futures trading volume.

CME’s Bitcoin futures aren’t your typical crypto exchange products - they’re regulated and popular with institutional investors, which makes this delta-neutral strategy a go-to play for serious players.

Open interest has surged to record levels, with regulated, traditional players now dominating this space.

You need proof that spot BTC inflows are offset by futures shorts? Just look at CME’s all-time-high open interest.

This doesn’t mean Bitcoin’s growth is blocked.

Underlying fundamentals are strong, and I see real, non-arbitrage-driven demand that will impact price.

Bitcoin’s strength is in scarcity and decentralization, and as central banks continue to print more fiat, Bitcoin’s appeal grows.

While cash-and-carry is responsible for dampening price action, organic demand from retail, institutional, and sovereign buyers will overpower these short-term strategies.

Future is bullish, and as cash-and-carry trades level off, real demand will have room to move the price.

👇 What do you think?

Are you waiting on organic demand to push prices higher, or is market structure here to stay?

Sentd this to someone who doesn't understand how crypto markets work.

Follow 👉 Anton Golub & share ♻️ your network

*NOT financial advice

do you think the trade is also happening through MSTR, i.e people buying MSTR and shorting bitcoin maybe through futures?