BlackRock Turns to Bitcoin to Hedge Against $35 Trillion Crisis

Bitcoin as a Global Hedge against central bank money printing

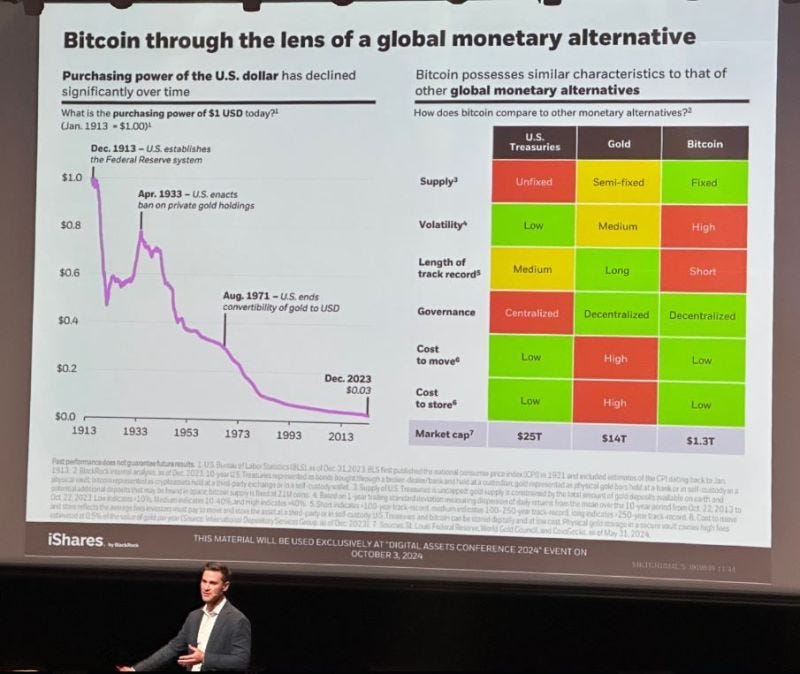

World’s largest asset manager is turning to Bitcoin - not just as an asset, but as a hedge against global financial instability.

BlackRock’s move is bigger than just another crypto bet.

It’s about preparing for collapse of central bank liquidity injections and endless money printing.

They’re not just buying Bitcoin - they’re enabling you to access it safely and securely.

Why Bitcoin?

1. Volatility with Upside Potential

BlackRock knows Bitcoin isn’t Perfect, but volatility works both ways - the higher the risk, the greater the reward.

2. Hedge Against Central Bank Madness

As global debt skyrockets, Bitcoin offers an alternative to fiat currency debasement.

3. Institutional Access via Safe Products

Through ETF products and secure exchanges, BlackRock is making it easy for you to access Bitcoin without worrying about wallets and keys.

Blackrock isn’t just hedging portfolios - it’s about sovereign independence.

In the future, you will see central banks adding Bitcoin to their balance sheets, using it as a monetary hedge against US dollar dominance.

Imagine a world where governments buy Bitcoin as a reserve asset, making your money FREE from US control.

BlackRock isn’t betting on crypto’s past- it’s positioning itself for the future.

As my dear friend Faruk Arslan says, BlackRock is betting on Bitcoin to save against a $35 trillion crisis.

👇 What’s your take?

Is this the tipping point for institutional Bitcoin adoption? Or is it still just a speculative play?

Shared this with someone who still doesn't believe in Bitcoin.

Follow 👉 Anton Golub & share ♻️ with your network - the future of finance is unfolding right now.

*NOT financial advice