Collapse of Crypto Shadow Banks: How 4.3 million crypto investors lost $46 billion in 5 months

Fascinating study by the Federal Reserve Bank of Chicago on the collapse of the world’s largest Crypto Shadow Banks!

Crypto Shadow Banks had a simple & highly attractive pitch: loan us Bitcoins or stablecoins and receive “guaranteed” interest rate payments of 8%. At the same time, interest rates on bank accounts were effectively 0%. Celsius told its clients that “Banks are not your friends” and “Unbank yourself,” and Voyager Digital urged them to “Beat your bank.”

I have written before that Crypto Shadow Banks have been under regulatory scrutiny.

Coinbase received a warning from the U.S. Securities and Exchange Commission (SEC) for its Earn product. BlockFi paid a $100 million penalty for violating securities laws by offering unregistered securities. SEC brought the same charges against Genesis & Gemini and against Celsius by several state regulators.

FED study finds 3 shocks that lead to the demise of Crypto Shadow Banks 👇

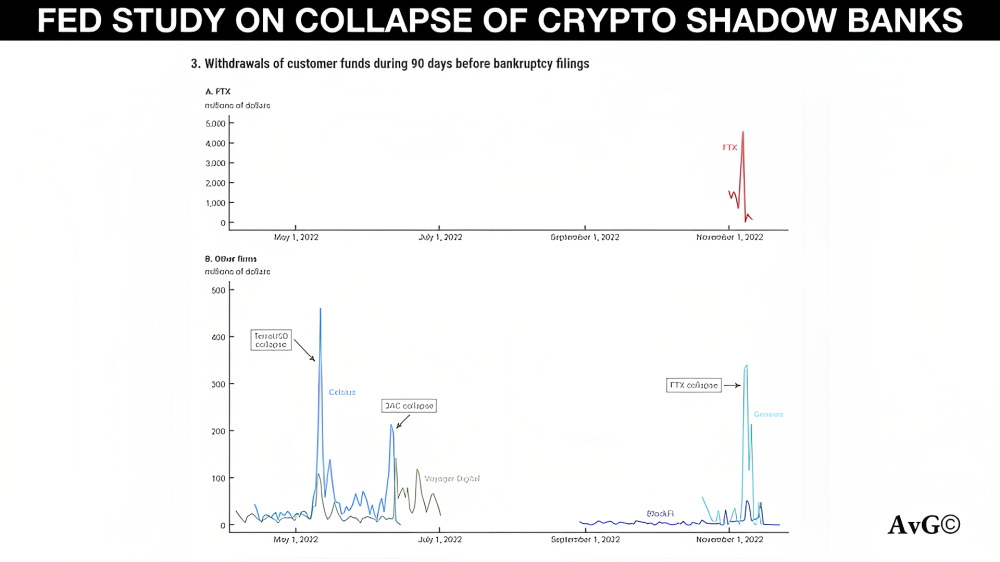

1️⃣ The collapse of the TerraUSD stablecoin. Celsius and Voyager Digital saw outflows of 20% and 14% of funds, over 11 days. Celsius had invested almost $1 billion in TerraUSD. BlockFi had outflows of $4.4 billion.

2️⃣ The failure of the crypto hedge fund Three Arrows Capital (3AC), because of the collapse of TerraUSD. Celsius and Voyager Digital had outflows of 10% and 39% of funds. Voyager outflows started the day Celsius paused withdrawals. BlockFi had $3.3 billion in outflows.

3AC borrowed $2.4 billion from Genesis, $1 billion from BlockFi, $350 million, and $328 million from Voyager. All of the loans were uncollateralized.

To survive, Genesis received a loan from Digital Currency Group (DCG). BlockFi got investment from FTX, with a right to acquire BlockFi. Voyager got a credit line from Alameda but declared bankruptcy anyway.

3️⃣ The failure of FTX in November 2022. FTX reported outflows of 37% of funds, within two days. At Genesis and BlockFi, clients withdrew about 21% and 12% of their funds. At this point, BlockFi was effective without any assets.

The collapse of Crypto Shadow Banks was different than typical bank runs 👇

⛔ Clients of Crypto Shadow Banks did not have protection like deposit insurance, but they were under the illusion their investments were safe. Crypto Shadow Banks lied about their exposure to the collapse of TerraUSD, the FDIC insurance of client deposits, and FTX led by SBF turned out to be a scam.

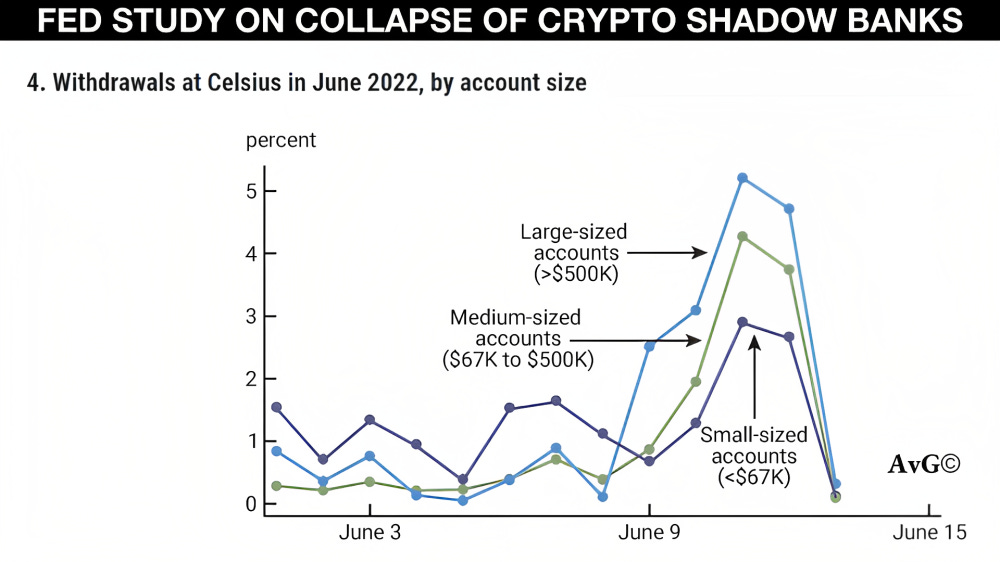

🧠The bank runs were led by sophisticated institutional clients. Clients at Celsius with over $500,000, were the fastest and withdraw the most.

🤖The runs were purely electronic, with clients withdrawing funds through apps or web portals with ease.

💧 Crypto Shadow Banks underestimated the magnitude of the bank runs. Their liquidity buffers were insufficient, if they ever even existed.

The collapse of Crypto Shadow Banks put severe pressure on Silvergate Bank and Signature Bank, which closed or failed in 2023.

#fed #federalreserve #crypto #shadow #bank #web3