CRYPTO INDUSTRY SECRETS: Non-liquidating accounts

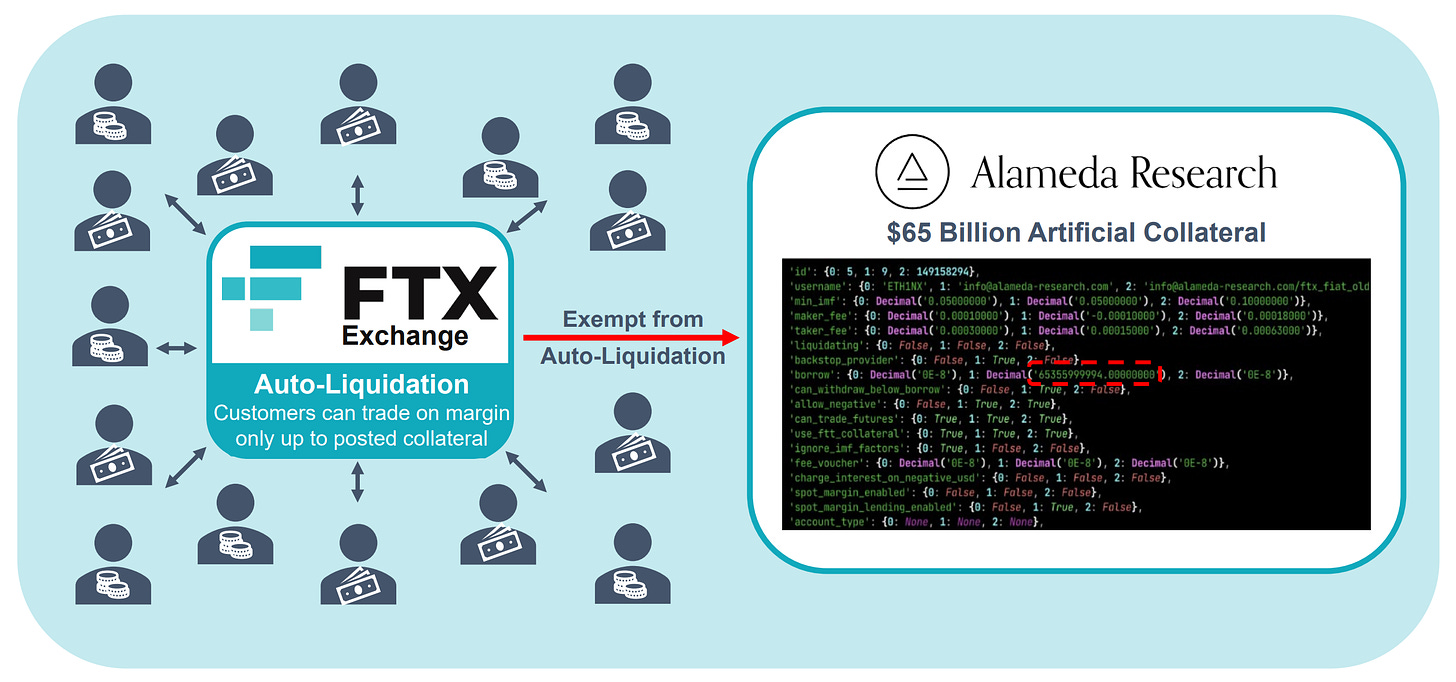

Hidden in the bankruptcy documents of the crypto exchange FTX, was a statement that Alameda Research had a negative balance of several billion!

The bankruptcy documents of the cryptocurrency exchange FTX provide a remarkable insight into the secretive world of the crypto shadow banking ecosystem, allowing the public and the regulators to get a view of behind-the-curtain activities, reserved for the "insiders" of the crypto industry: the world's largest traders, market makers, and exchanges.

Most people would be shocked by the concept of an exchange allowing such large losses since the everyday experience of trading is very different - once a trader’s losses exceed collateral, his position is sold & trading stops.

The secret exemption allowing such scenarios is the existence of non-liquidating accounts, one of the crypto industry’s most harmful secrets.

Liquidation is a normal process executed to reduce the risk of a trader’s position & prevent the situation of balance at a trading account from going negative when the losses exceed the posted collateral.

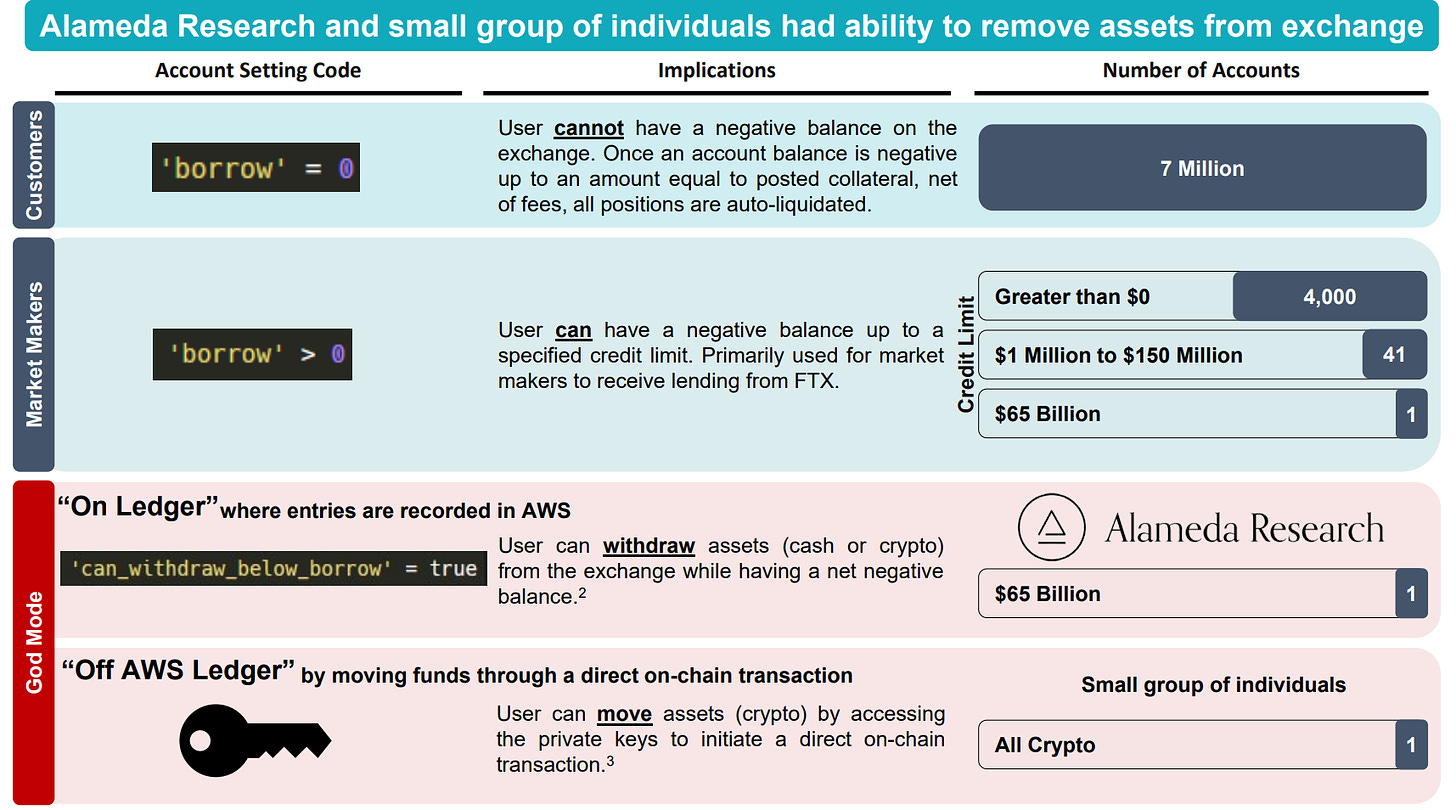

Non-liquidating accounts have the liquidation feature turned off, and a trader does not need to settle losses!

A trader with a non-liquidating account who does not manage his position correctly can end up in a situation where losses exceed available collateral, hence owing a massive negative balance to the exchange.

For instance, a trader can deposit $1’000’000 of collateral, but due to bad risk management, ends up having a loss of $10’000’000, hence a negative balance of $9’000’000, effectively owing the exchange.

Among the 7 million users of the bankrupt crypto exchange FTX, about 40 privileged traders were allowed to run into a net negative balance of up to $150 million.

The exchange would never give a non-liquidating account to a normal user!

Non-liquidating accounts are reserved for the world’s largest market makers & traders.

Market maker gets a non-liquidating account to have a lot of freedom to provide liquidity since providing liquidity for innovative products requires a large amount of capital & trading infrastructure.

Crypto exchanges, in their never-ending pursuit for volume, give non-liquidating accounts to the world’s crypto whales, since they are a large source of trading activity, which results in revenues for the exchange.

There’s a subtle way of discovering exchanges with non-liquidating accounts gone wrong, by observing a steep drop in Open Interest after(!) a large price move.

The derivatives exchange would approach the trader with a large negative balance, as well the trader(s) with profits - since such situations are zero-sum - and ask them to net-out the positions off the market.

The traders with profits would then be shocked to find out their profits are not what they thought, since the negative balance from the non-liquidating account is the gap!

If the exchange cannot net-out the massive negative balance, the rumors of insolvency start, effectively a bank-run happens and withdrawals are stopped…

The solution to the hidden credit lines and the serious risks they pose to the crypto ecosystem, would be to separate the matching engine of the exchanges where the trades happen, from the clearing & settlement.

Prime-brokerage system can be created that nets-out offsetting trades, improves capital efficiency, and removes the risks of credit lines blowing up and hurting all the clients of the exchange

The lawsuit against Sam Bankman-Fried will reveal the crypto industry's biggest secrets and those painful learning experiences remind us to build a better foundation for the future.

My goal is to provide insider insights into how the industry operates & shed light on the behind-the-scenes activities.