CRYPTO LIQUIDITY COLLAPSE CONTINUES: Market makers flee Binance.US

Once again, Kaiko does a fantastic job for the whole crypto ecosystem, providing unique insights about liquidity and market structure, from their enormous & high-quality data sets.

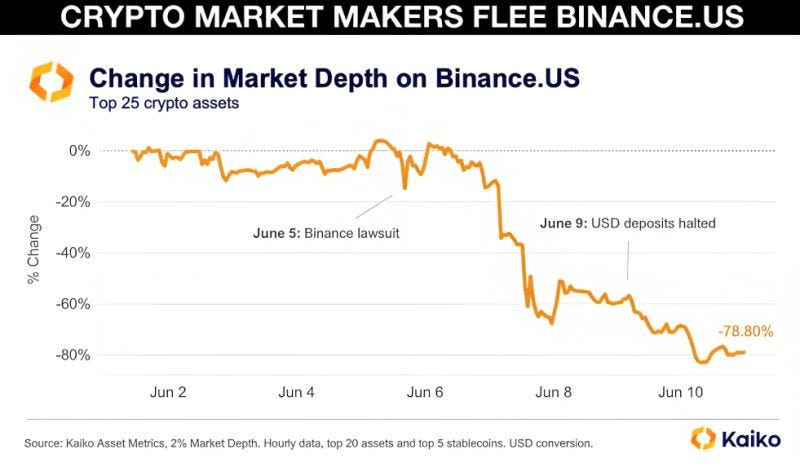

The beautiful graph of market depth in the +-2% price range for the top 20 cryptos traded on Binance.US + top 5 stablecoins, shows a collapse in liquidity of almost 80%.

The key event causing the collapse of liquidity on Binance.US is the lawsuit brought on by U.S. Securities and Exchange Commission against Binance for offering & selling unregistered securities, operating an unregistered securities exchange, clearing agency & broker-dealer, wrongfully onboarded US clients, in addition to failing to implement KYC/AML.

Soon after the announcement of the lawsuit, Binance.US halted USD withdrawals, due to the apparent loss of a fiat banking service partner.

Wintermute and Keyrock communicated to The Block they are the liquidity providers who exited Binance.US following the lawsuit — can this be confirmed?

As I have stated before, the crypto liquidity crisis will continue and is a consequence of:

1️⃣ World’s largest market makers (Jump Crypto, Jane Street, Wintermute, Keyrock) pulling back from trading & providing liquidity,

2️⃣ Collapse of Silvergate Bank and Signature Bank, which operated SigNet and SEN, critical pieces of the global crypto settlement infrastructure, enabling the real-time and low-cost transfer of digital assets,

3️⃣ Collapse of the largest Crypto Shadow Banks, which left the borrowing & lending space frozen, and liquidity for lending to hedge funds, market-makers, and prop shops dried up,

4️⃣ Increased margin requirements and reduced maximum leverage for market-makers, prop shops & hedge funds,

5️⃣ Severe regulatory backlash, with US regulators targeting the world’s largest crypto exchanges.

The nuclear crypto winter continues!

#crypto #marketmaker #liquidityprovider #liquidity #web3 #binance #sec