Crypto Liquidity Crisis Continues

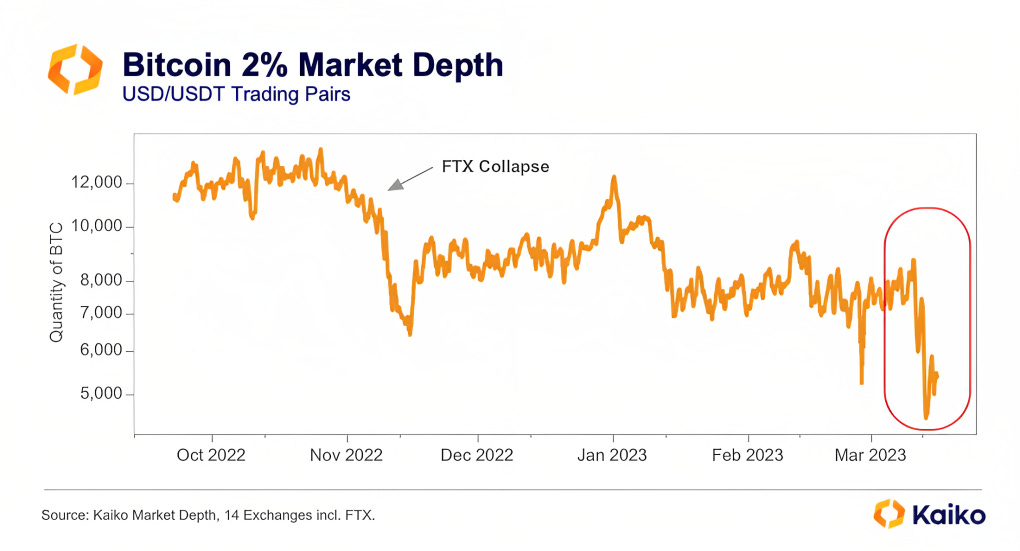

👉 Data service provider Kaiko has created a beautiful graph showing the liquidity in the +-2% price range for the BTC/USDT pair has dried up, impacted by key events:

1️⃣The collapse of SigNet & SEN payment rails locked out USD liquidity from crypto markets,

2️⃣Crypto Shadow Banking borrowing & lending is still frozen,

3️⃣Crypto Exchanges have slashed leverage & increased margin for market-makers,

4️⃣Liquidity disappeared overnight in the world’s most traded pair BTC/USDT after Binance ended its zero-fee program.

❌Both Signature’s SigNet and Silvergate’s SEN, provided critical pieces of the global crypto settlement infrastructure, enabling the real-time and low-cost transfer of digital assets. With the collapse of two US largest crypto-friendly banks, market-makers are facing severe operational problems, and some are pointing to Customers Bank’s 365/7/24 instant payment rails as a potential solution to the USD liquidity crisis. The USD pairs are being phased out by exchanges & traders, in favor of stablecoins, despite the challenges of those stablecoins keeping the peg to USD.

📊 Behind the scenes, the secretive Crypto Shadow Banking ecosystem has been severely shaken up and is frozen, with liquidity for lending to hedge funds, market-makers, and prop shops dried up, as the biggest shadow bank like Genesis is effectively out of business. In my discussions with the lender, I can confirm that the Shadow Debt Market, which strongly fueled the rapid growth of the crypto industry, has very few transactions going through. Large lenders that are still left standing, are reducing their exposure to debt-hungry crypto players.

🚩 Following the collapse of FTX and Signature & Silvergate bank, in an attempt to reduce counterparty risk, #crypto exchanges have increased margin requirements and reduced maximum leverage for market-makers, prop shops, and hedge funds. Liquidity providers have less firepower to act as a buffer at times of high volatility, which has helped so far to the upside, but we will eventually face a price drop.

💵 The world’s most traded pair BTC/USDT, suffered a #liquidity blow after Binance ended its zero-fee program, a super successful attempt to steal market share from other CEXs. With the zero-fee program, traders were willing to pay higher spreads, to the benefit of the market-makers. When the taker fee was reintroduced investors weren’t willing to pay a high spread, hence liquidity disappeared in the BTC/USDT pair on #Binance, dropping 70% overnight as market makers focused on more profitable markets. The zero-fee program ended up being a massive success and a slam-dunk for Binance, helping the #exchange gain a massive +20% market share since July, from 50.5% to 72% of all volume. Finally, Binance quietly stopped their auto-converting program (USDC to BUSD) and relisted back the USDC pairs.