I would NEVER buy Strategy, if I wanted to invest in Bitcoin

Why Strategy ($MSTR) is NOT a Bitcoin investment, but a high-risk financial engineering play fueled by leverage, volatility trading, and an 'infinite money glitch' that works - until it doesn’t.

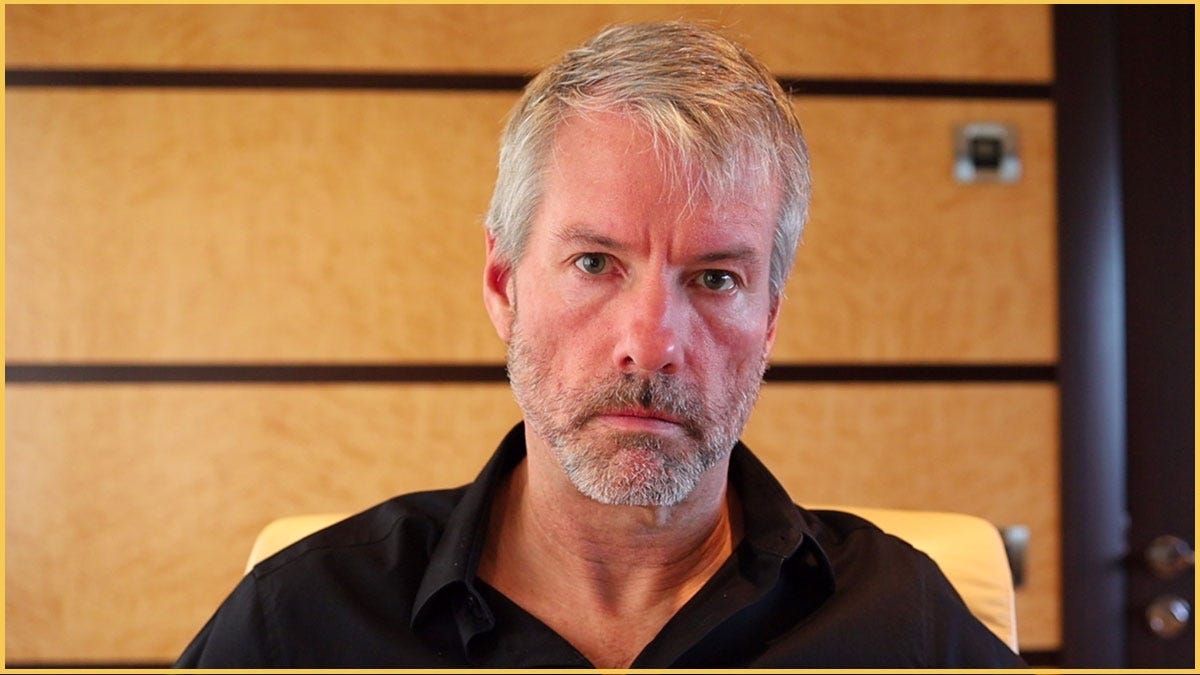

Michael Saylor makes it sound simple:

"Buy Bitcoin. Hold forever. Profit."

But Strategy ($MSTR) is NOT a pure Bitcoin play.

It’s a leveraged financial engineering product wrapped in Bitcoin marketing.

I explain what’s REALLY happening 🧵👇

1. Strategy Is NOT Bitcoin Exposure

If you buy Strategy shares thinking you're getting Bitcoin, you're wrong.

Strategy holds ~499,000 BTC ($43.7B)

But it also holds $8.2B in debt

Strategy stock price is at a massive premium to its Bitcoin holdings

You're not buying Bitcoin.

You're buying a hedge fund’s volatility trade with leverage risk.

2. Hedge Funds Use Strategy for Volatility Arbitrage

Why does Strategy’s stock move more than Bitcoin itself?

Because hedge funds love it for volatility trading.

Saylor raises capital via convertible bonds at 0% interest.

Hedge funds buy these bonds for a built-in option on MSTR stock.

Hedge by shorting Strategy stock or via Bitcoin futures.

Hedge funds don’t care about Bitcoin - only about volatility.

Strategy stock is a playground for volatility traders, not Bitcoin believers.

3. "Infinite Money Glitch" Only Works in a Bull Market

Saylor’s game plan:

- Issue 0% convertible bonds.

- Buy Bitcoin.

- Pump Strategy stock higher than its BTC holdings.

- Issue more stock at a premium.

- Repeat.

This only works as long as Strategy’s stock price stays irrationally high.

If Bitcoin crashes?

If Strategy stock collapses?

Entire cycle breaks down.

4. How a Liquidation Would Happen

Saylor says Strategy will "never" get liquidated.

But here’s how it actually could:

- Convertible bonds have a floor price.

- If Strategy stock crashes below bond conversion price, holders demand repayment.

- If Strategy can’t raise capital, it must sell Bitcoin.

- Selling Bitcoin crashes Bitcoin’s price.

Lower Bitcoin price = even more forced liquidations.

Downward death spiral.

This isn’t just theory. It’s exactly how leverage blowups happen.

5. Would You Trust Saylor’s Risk Management?

Saylor isn’t managing risk.

He’s betting everything on Bitcoin going up - forever.

His latest move?

Raising another $2B to buy more Bitcoin.

His belief:

“If Bitcoin drops to $1, we’ll just buy more.”

Reality?

If Bitcoin drops 50%, Strategy stock collapses.

If Strategy collapses, it must sell Bitcoin.

If it sells Bitcoin, Bitcoin drops even more.

This is NOT how risk management works.

If You Want Bitcoin, Buy Bitcoin.

Strategy is NOT Bitcoin ETF.

Strategy is NOT simple Bitcoin exposure play.

Strategy is a leveraged, debt bet with massive risks.

I would NEVER buy Strategy if I wanted Bitcoin.

Bitcoin is scarce, decentralized, and liquid.

Strategy is leveraged, centralized, and dependent on capital markets.

Would you buy Strategy ?

Or you prefer holding Bitcoin?👇

*NOT financial advice

Strategy will offer outsized returns on BTC because of Saylors ability to tap debt markets, and sell new shares - BOTH of which increase the BTC per share…… There is virtually no chance of him having to liquidate with a 48M bag and only 8B in debt - and most of that 8B will convert….. The convert buyers are the ones leveraging volatility, not Saylor - he is selling it…..If you are bullish Btc it seems a little shortsighted to not have some Mstr exposure…What Saylor has done to the Mstr balance sheet the last 4 years is mind blowing.

Hot takes, I love it!