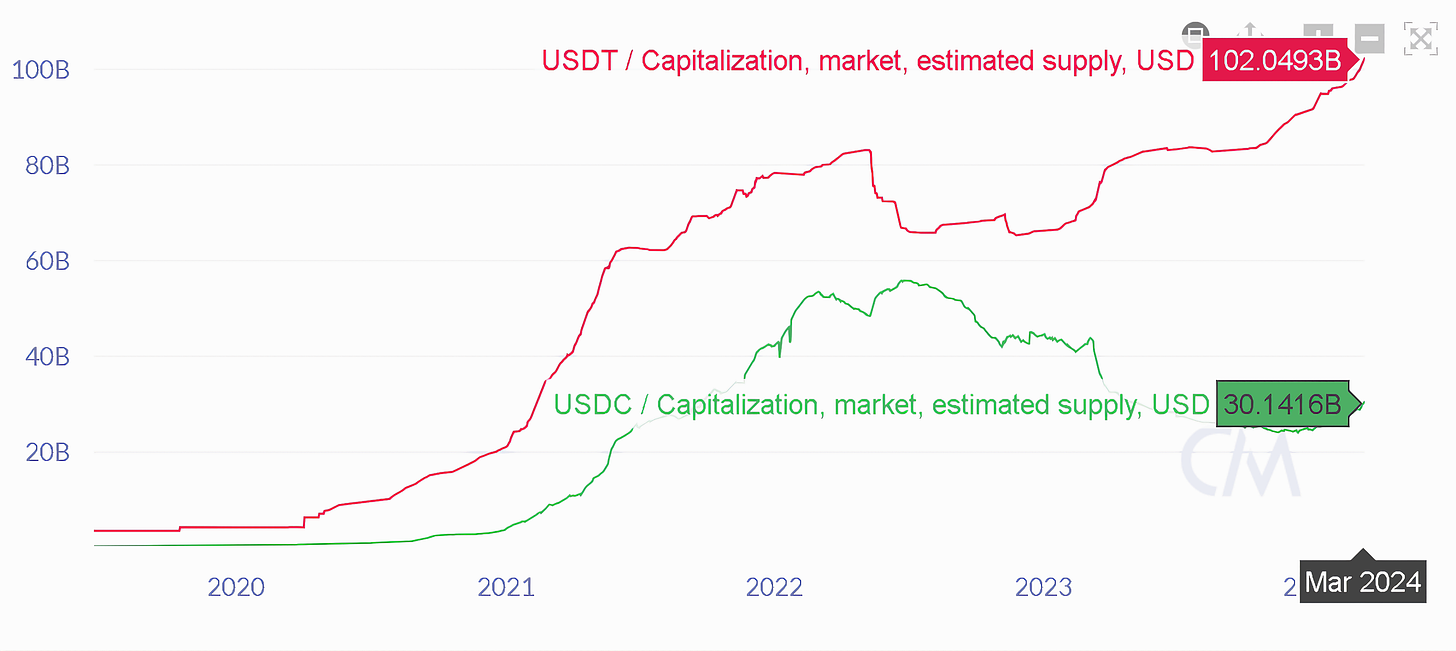

Tether is winning the stablecoin wars

Nothing can stop USDT on its way to complete dominance, except the US regulator.

When the crypto market crashed in May 2022, it seemed Circle’s USDC came close to overtaking Tether, after USDT briefly lost its US dollar peg.

But it never happened…

Federal Reserve Board raised interest rates from 0% to 5.5% and investors moved out of stablecoins into US Treasury bonds.

Circle revealed that $3.3 billion of its reserves was stuck at the collapsing Silicon Valley Bank and the damage was done.

At the same time, the New York regulator ordered Paxos to stop minting Binance USD (BUSD).

Today, USDT is the undisputed king of stablecoins, with a $100+ billion market cap.

Circle’s USDC is still the darling of DeFi and pretty much all DEXs, AMMs, borrowing and lending protocols use USDC for liquidity purposes, instead of USDT.

Circle wants to distance USDC from the "speculative" crypto industry and get closer to "real-world" applications, like payments and remittances - this needs to be understood in the context of Circle's rebranding goals, they will give another attempt at an IPO.

Most people get completely wrong about how stablecoins are used in the crypto world...

You might think stablecoins are used for payments and remittances - as Circle tries to portray it - but this is a microscopic use-case and irrelevant from the perspective of total stablecoin turnover.

Stablecoins are used by the world's largest traders - market makers, prop traders, and hedge funds - as a settlement mechanism to rebalance liquidity between the top crypto exchanges and trading venues.

Crypto traders want to move their funds quickly between USD and crypto…unfortunately, the banking system doesn’t make it easy to do that, as it isn’t set up to move money quickly and affordably.

Crypto traders needed a token on a public blockchain that could be moved around fast & easily and have the same value as a US dollar.

This led to the birth of stablecoins and Tether was the first USD stablecoin, that can be used across a wide range of blockchains and exchanges.

No longer would exchanges and traders need a bank account to hold fiat - you might remember that Binance started in 2017 without fiat rails and didn’t have a fiat bank account for many years, even when it became the world’s largest crypto exchange.

The biggest competition to stablecoins will be Central Bank Digital Currencies (CBDCs).

My clear opinion is that CBDCs should not be touched by retail.

The only use-case of CBDCs is to net out positions among regulated financial services providers.

CBDCs in the hands of the governments will be used as a control mechanism and surveillance tool.

#circle #tether #stablecoin #cbdc #usdt #usdc