The secret of “scaling law” patterns: How to connect INTRINSIC and PHYSICAL time

Intrinsic time is one of the biggest discoveries in finance and will completely change how you predict prices in financial markets.

Intrinsic time is different from physical time, because it “ticks” when there is market activity.

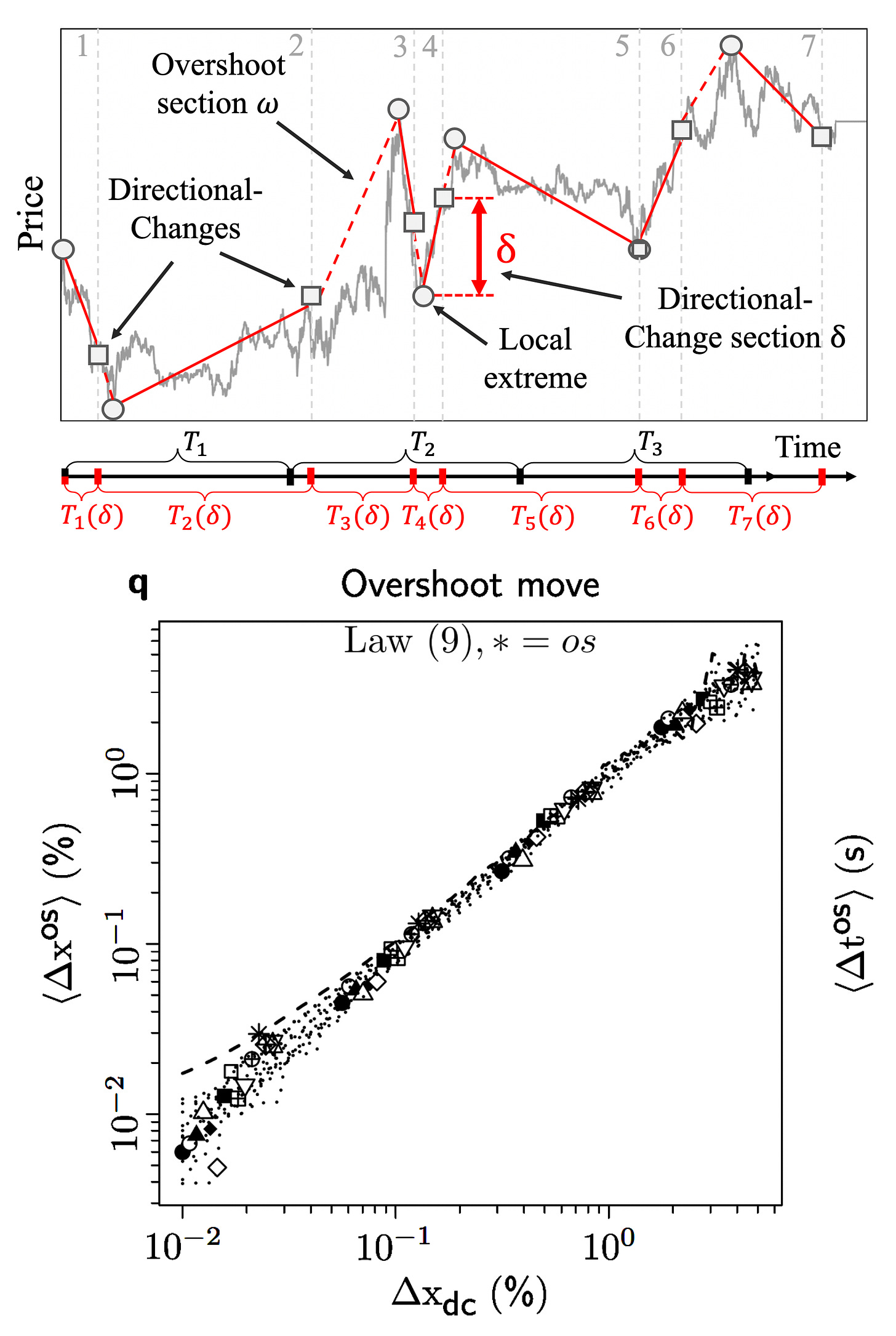

When the price does a trend reversal of the given size, a “directional change” of price happens & the intrinsic time ticks. Then the price “overshoots” until the next trend reversal (i.e. directional change) happens, like in the picture I provided.

A long overshoot is an indication of a lack of liquidity, and the variability of overshoots describes market liquidity.

Traditional finance analysis uses equally spaced prices for inputs (seconds, minutes, hours, or days), and it misses the real factors influencing the financial markets.

The idea of using different time clocks appeared in the 1960s with the famous Benoit Mandelbrot but it never flourished because analysts couldn’t connect physical time with event time (intrinsic, transaction, or volume-based times).

.

Mandelbrot was brilliant in introducing fractal theory and “scaling law” patterns in the analysis high-frequency data, but he didn’t discover that scaling laws are the key to connecting physical and event-based time.

“Scaling laws" are universal laws and significantly enhance our understanding of how prices behave. In financial markets, frames of reference and fixed points are hard to come by and often illusory, so it’s extremely important to discover “scaling laws” to understand financial markets.

On the picture, you can see the overshoot "scaling law" in action, showing that the average overshoot of price equals the directional change threshold (chosen for intrinsic time).

Intrinsic time and the “scaling law” patterns solve Mandelbrot’s mystery - it is possible to construct a bridge between the new and old concepts of time.

The secret is resolved by discovering a mathematical formula that connects the volatility of price (in physical time) with the variability of overshoots (i.e. liquidity) & the number of directional changes (i.e. instantaneous volatility).

With that mathematical formula, the mystery is finally solved, and a connection between physical & intrinsic time is finally discovered!

I will write more about intrinsic time, directional changes & overshoots, and how to use “scaling law” patterns in price analysis & trading.

Richard Olsen, the founder of Lykke - a ZERO fee crypto exchange, has created a tool called ATTMO, where you can predict the crypto markets with the “scaling law” patterns from Intrinsic Time.

Head over to ATTMO's website and check out the patterns!

#intrinsictime #attmo #lykke #mandelbrot #crypto