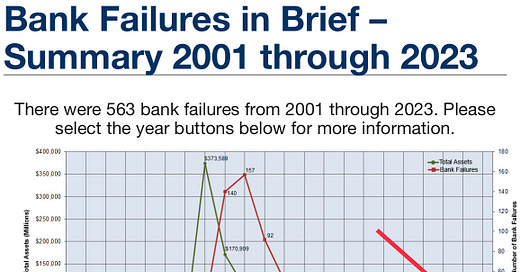

US banking crisis continues, 5 failed banks in 60 days, First Republic Bank taken over & sold to JPMorgan Chase

Another troubled US 🇺🇸 bank has collapsed. After the failure of the Silicon Valley Bank, Signature Bank, and Silvergate Bank, the US banks are in deep trouble as the banking contagion continues.

How is it possible that US banks are falling like dominos? 👇

Banks can hide their losses by classifying the bonds they purchased as “Held To Maturity”. Instead…

Keep reading with a 7-day free trial

Subscribe to Anton’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.