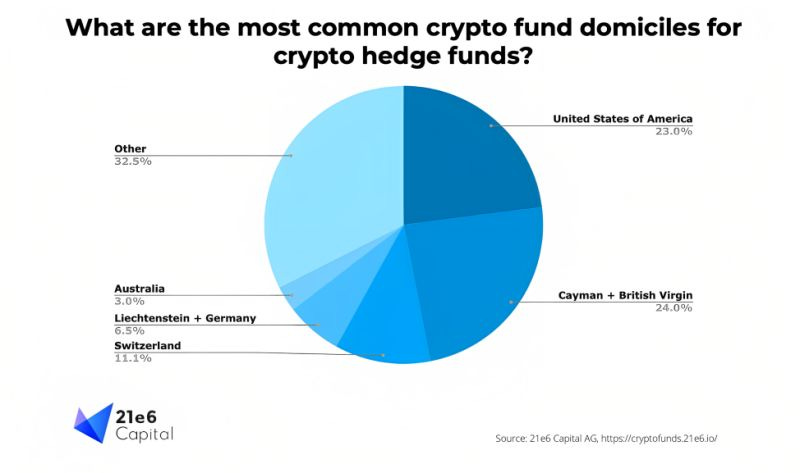

Where are crypto hedge funds located?

Amazing insights into the crypto asset management ecosystem by 21e6 Capital, a research company with the coolest name ever!

Most crypto hedge funds are domiciled in the US, Cayman Islands, and British Virgin Islands, followed by Switzerland, Liechtenstein, Germany, and Australia.

It’s not really a secret that US crypto companies are experiencing severe regulatory backlash, coupled with a banking collapse where consequences are comparable to the 2008 Financial Crisis. The failure of Signature Bank and Silvergate Bank, key US crypto banks left the ecosystem without friendly & reliable partners.

I can provide insights on the situation in Switzerland, as I have managed an investment product and have first-hand insights into the reality of managing a Swiss crypto fund.

Firstly, nobody is actually setting up a fund in Switzerland, as we are totally uncompetitive offering flexible and cost & tax-efficient investment vehicles.

When people say “Swiss crypto hedge fund”, they mean that the Investment Management (IM) company is based in Switzerland and regulated by FINMA, but the vehicle the IM is managing is (most often) off-shore.

Prior to 2023, it was actually quite “simple” to set-up a crypto hedge fund in Switzerland, since asset managers with less than CHF 100 million of AUM would only be supervised by one of the Self-Regulatory Organizations (SROs), and the strong FINMA regulatory supervision would kick-in once AUM is over CHF 100 million.

That all changed on January 1st, 2023 with the new regulation: SROs are gone, and now every crypto hedge fund is directly regulated by FINMA. While that makes Switzerland less attractive to set-up a crypto hedge fund, there are asset management service providers that can take on the regulatory burden, and make you a “sub-delegated investment manager”.

For asset managers who want to do everything themself, they have to provide a credible business plan, demonstrate having enough capital (both for regulatory requirements & operations), and have persons in the Executive Management with “substantial & relevant” asset management experience. Finally, you should select KYC/AML partner (usually externalized) and FINMA-authorized auditor.

Switzerland will continue to be attractive for crypto hedge funds to set-up shop, due to the enormous number of high-quality crypto service providers. When the US gets its act together and UAE progresses further with the development of crypto infrastructure, the competition will be on and we will see a flight of crypto hedge funds to the world’s biggest financial hubs.

#crypto #hedgefunds #switzerland #research #finma #usa